can you pay california state taxes in installments

It may take up to 60 days to process your request. The state typically gives a taxpayer three to five years to pay off a balance once a California state income tax payment plan has been granted.

Favorable California Pass Through Entity Tax Changes

The taxpayer must agree to the following Taxpayer Installment Agreement Conditions while in an Installment Agreement.

. Pay a 34 set-up fee that the FTB adds to the balance due. For example the State of California Franchise Tax Board. I have installments set up for my federal taxes but I did not see an option for California state taxes.

Like the IRS and many states the California Franchise Tax Board offers taxpayers the ability to pay taxes due over time. Can you pay california state taxes in installments. The requested tax instalment payment is always equal to 14 of the tax owing at the end of the previous year.

Online at the FTB website. Franchise Tax Board State of. An application fee of 34 will be added.

By completing Form FTB 3567 and sending it to the State of California Franchise Tax Board PO. 18 hours agoThe jackpot for Saturday nights drawing is now the largest lottery prize ever at an estimated 16 billion pretax if you were to opt to take your windfall as an annuity spread. By calling 1-800-689-4776 during normal business hours to use the states Interactive Voice Response IVR system.

It is your responsibility to. If you live in New York for example youd pay the highest tax rate in the country -- 882. If you are unable to pay your state taxes you can apply for an installment agreement.

More In News Dont panic. Box 2952 Sacramento CA 95812-2952. For example if you reported an outstanding tax bill on your 2019 tax return on July 15 2020 in most cases the IRS has until July 15 2030 to collect the tax from you.

Your remittance voucher is included in your instalment reminder package the CRA mails to you unless you pay instalments by pre-authorized debit. The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code. So for example if your last income tax bill came to 3600 the.

Usually you can have from three to five years to pay off your taxes with a state installment. What do you do if you owe state taxes and can t pay. If you opted for the lump sum youd end up with just 316393862.

By completing Form FTB 3567 and sending it to the State of California Franchise Tax Board PO. As an individual youll need to. If you cannot pay the full amount of taxes you owe you should still file your return by the deadline and pay as.

If you are unable to pay your state taxes you can apply for an installment agreement. Enroll in a Monthly Payment Plan.

Irs Accepts Installment Agreement In Riverside Ca 20 20 Tax Resolution

If The Seller Of The Subject Property Has Paid Both Chegg Com

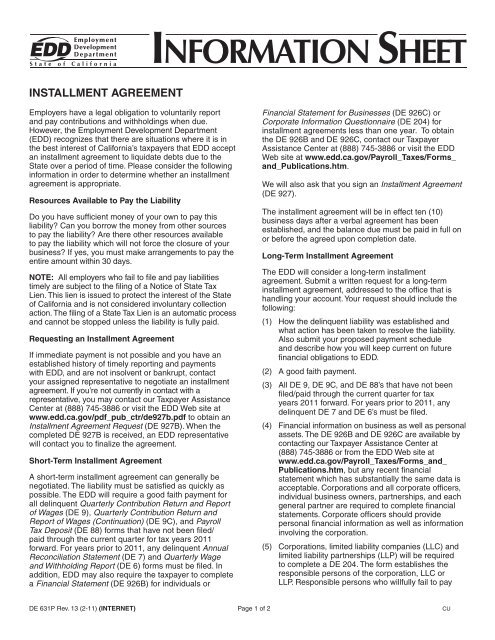

De 631p Employment Development Department State Of California

California Back Taxes Resolutions Overview Ftb

Understanding California S Property Taxes

Irs Payment Plan Installment Agreement Options Nerdwallet

Kern County Treasurer And Tax Collector

California Tax Filing Deadlines 2022 Irs Info And Forms The Sacramento Bee

California State Tax Software Preparation And E File On Freetaxusa

How To Request A Payment Plan Youtube

How To Get Your Tax Refund As Quickly As Possible Youtube

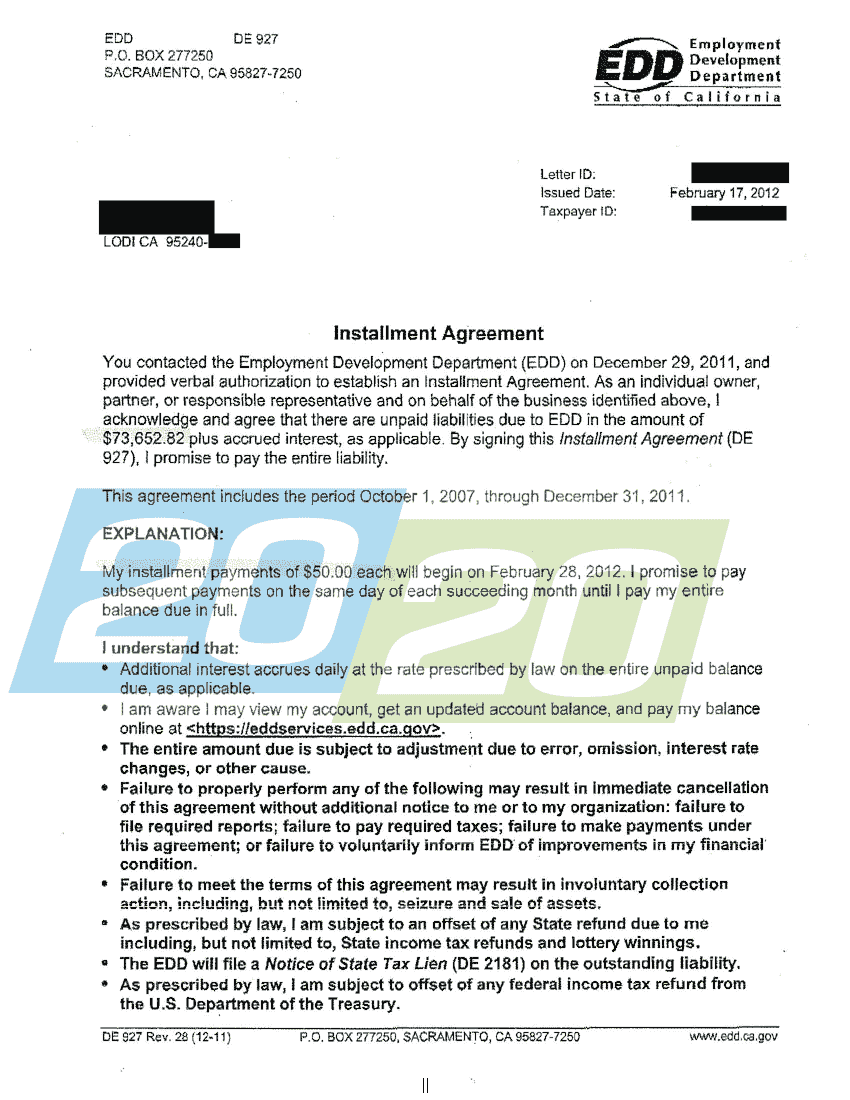

State Accepts Payment Plan In Lodi Ca 20 20 Tax Resolution

Mississippi State Tax Payment Plan Details

Property Tax Installment Plans Treasurer And Tax Collector

Estimated Tax Payment Due Dates For 2022 Kiplinger

Butte County California Press Release For Immediate Release March 25 2020 Butte County Treasurer Tax Collector Addresses Confusion Over Tax Deadlines Oroville Calif With The Recent Extensions Of The Federal And State

Property Tax Installment Plans Treasurer And Tax Collector

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire